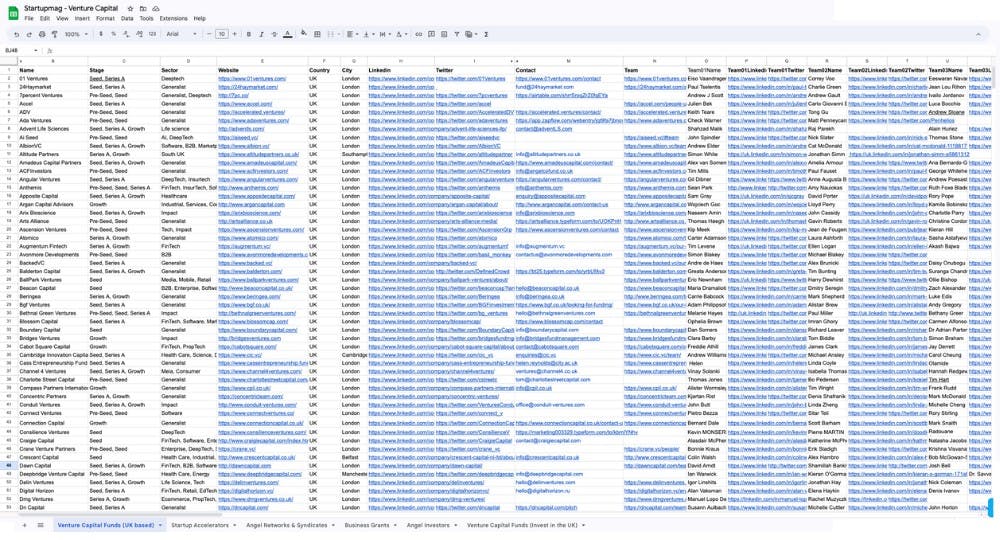

| Example | Name | Location | Website | Contact 1 | Contact 2 | Contact 3 |

|---|---|---|---|---|---|---|

AlbionVC (7 contacts) | London, UK | albion.vc | Andrew Elder | Cat McDonald | Christoph Ruedig | |

Balderton Capital (22 contacts) | London, UK | balderton.com | Greata Anderson | Colin Hanna | Francesco Corea | |

Forward Partners (6 contacts) | London, UK | forwardpartners.com | Nic Brisbourne | Matt Bradley | Hasam Silva | |

Index Ventures (13 contacts) | London, UK | indexventures.com | Jan Hammer | Julia Andre | Ari Helgason | |

Octopus Ventures (7 contacts) | London, UK | octopusventures.com | Akriti Dokania | Alliott Cole | Caitlin Wale |

Over the years, we’ve spent a lot (A LOT) of time looking for angel investors and venture capital firms to grow our different businesses. One thing that never changes, whether you are an early stage startup looking for pre-seed or seed funding, a scale up in the middle of a series A/B round or even a consultant looking for VC partners is...

... you will need some kind of a VC list or a database to get started!

And a database doesn’t just mean a list of websites. You will need more than that. You will need to know who the people are in each organisation, what their linkedin’s are and their twitters accounts. And you also need to get to know these individuals before you start engaging.

Now, this kind of database literally takes weeks to build. So, we decided to build it for you:

What’s in the database?

You will receive a list of UK based venture capital firms. Each with a selection of quality and verified fields that will help you start engaging.

6,062 VC Investors, 571 Venture Capital Funds, 59 angel networks, 35 accelerators, 695 twitter accounts.

6,062 VC Investors, 571 VC Funds, 59 networks, 35 accelerators, 695 twitters

- All formats: xls, ods, csv, pdf, tsv

- No extra software required

- Connects to all CRMs

- Instant delivery 24/7

Testimonials

Find out how Startupmag venture capital database worked for them

It was a perfect experience to work with John. He was super customer friendly and his data are genius. Absolutely recommended!!!!

Really easy process for sourcing investor data! A simple purchase online gives you access to thousands of investors including email addresses as well as LinkedIn links. I wasn't particularly looking forward to the process of researching and creating my own list so really glad I found this!

Having already got value out of StartupMag's Venture Capital Database, which has been instrumental in kickstarting our fundraising charge, Founder JP reached out and offered to spend some time looking at our deck and has provided us with some great feedback. Looking forward to the next call! Highly recommend.

All other lists simply show a top 10 of VCs that everybody ends up contacting. I was really surprised with the number of players in London: firms and investors.

I bought StartUpMags spreadsheet to get a list of VCs, Angel investors and grants. Saved me days of work. Incredible value for money. They also have some well researched content on the site like the guide to SEIS.

Good value ! Good deal !

I paid, received the spreadsheet by email and started sending my deck within a few minutes.

Instant Access

Investor

Database

£59

6,062 VC Investors, 571 Venture Capital Funds, 59 Angel Networks, 35 Accelerators, 695 x/Twitter.

Instant access to your investor list.

Frequently asked questions

How will I receive my database?

As soon as we receive your payment, you will access your very own dashboard with a direct link to download your database.

Can I see a sample?

Of course, click here to check out a sample of 5 venture funds.

What is the database format?

The database is stored in a simple spreadsheet that you can access through Google Drive, Microsoft Excel or Open Office. The format is perfect for easy read, analysing and compatible with any CRM.

What's not in the database?

(no surprises)

We do not provide direct email addresses to all partners. We cannot guarantee that all venture funds have a company linkedin or twitter account. But if they do, you will have it.

Do you offer refunds?

Unfortunately the nature of the product doesn’t allow for refunds. If you have the data, well... you have the data. We suggest that you consult the sample above before proceeding with the purchase. It’s a great representation of the rest of the database.

Didn't find your answer?

Please don't hesitate to contact us here. We'll do everything we can to help.

Get to know venture capital?

Venture capital is money invested by venture capital “firms” into fast growing companies. These firms or funds are also called venture capitalists.

We have put quotes around the word ‘firms” as recently the line between angel investors and venture capital is blurred. Below is a brief description of each venture capital category.

Venture capital firms / venture capital funds

A venture capital firm groups together the investment of several investors into a fund. Each investor then becomes a limited partner. Investors can be individuals, businesses and corporations but also other funds.

Most venture capital funds have a lifetime of 5-10 years. That is the time that is allotted to invest all the capital and return profits to the investors.

One single venture capital firm can raise several funds in different sectors, time horizons and deal sizes.

Corporate venture capital

CVC (corporate venture capital) are funds set up by large organisations such as Google Ventures or Salesforce ventures. This category is growing fast as tech businesses are gaining resources and progressively becoming the largest businesses in the world.

Family office venture capitalists

Family offices are privately held companies that manage the investments of a wealthy family. Traditionally risk averse and closely linked to private equity, these entities have been joining forces with aggressive venture capital firms to invest in fast growing tech companies.

Angel investor

Large angel investors can have their own researchers and admin staff. The structure will be run like a family office but with the targeting and aggressiveness of an early stage venture capital fund.

Angel syndicate

Some angel investors get together in business angel syndicates. Here, the syndicate will generally see more deals than an individual angel and the angel can decide whether or not they would like to invest.

Venture capital in accelerators

Accelerators and incubators are generally backed by large corporate organisations that are trying to dip their toe into innovation by helping young businesses grow within their framework. They will invest in startups with funds but also mentorship and partnerships.