Bleap Secures $2.3 Million in Pre-Seed Funding

Bleap, a forward-thinking fintech startup based in London, UK, recently announced that it has successfully secured an impressive $2.3 million in Pre-Seed funding. The funding round was spearheaded by Ethereal Ventures, with valuable contributions from several notable investors including Maven11, Alliance DAO, and Robot Ventures. Furthermore, a group of angel investors representing well-known companies such as Revolut, Phantom, OKX, EigenLayer, and Consensys also took part in this lucrative investment round. The capital raised is earmarked for expanding Bleap's operations as well as enhancing its development endeavors, ensuring that the company can effectively translate its ambitious vision into reality.

Founded by the innovative duo Joao Alves and Guilherme Gomes, both of whom have previously held positions at Revolut, Bleap aims to revolutionize the way users interact with their digital assets.

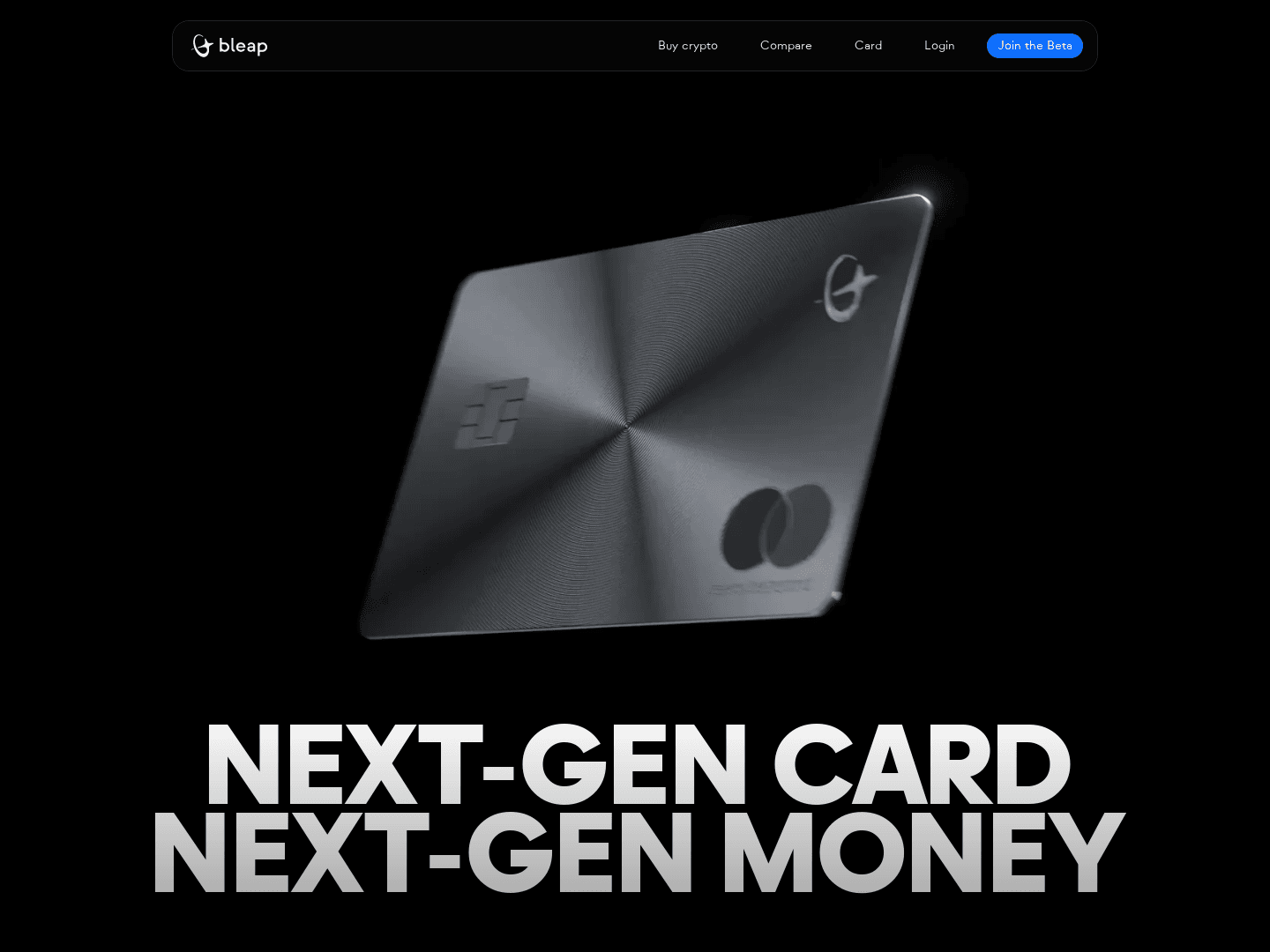

The company has developed a self-custodial wallet that is seamlessly integrated with a Mastercard debit card, allowing users to spend their stablecoins directly in the real world. One of the standout features of the app is the absence of conversion fees, enabling users to handle their digital currencies with greater efficiency. Additionally, Bleap offers up to 2% cashback on purchases, making it an appealing choice for users seeking to maximize the benefits of their crypto transactions.

Incorporated in both the UK and Poland, Bleap is also registered as a Virtual Asset Service Provider (VASP) within the European Union, reinforcing its commitment to regulatory compliance and service excellence. Currently, the app is in a beta phase, available to a select group of users throughout Europe, with the official public launch planned for the first quarter of 2025. Once launched, Bleap aims to facilitate crypto payments across Europe, delivering a streamlined and user-friendly experience for those looking to navigate the world of decentralized finance. With its innovative features and strong backing from key investors, Bleap is well-positioned to make a significant impact on the fintech landscape within the coming years.

They've invested in Bleap

Get to know these Fintech investors

Click here for a full list of 6,908+ startup investors in the UK