Round Treasury Secures $2.1M for Startup Financial Solutions

Round Treasury is an innovative financial service provider based in London, UK, that has recently attracted attention from investors and the startup community alike. Founded by the dynamic duo of Hayyaan Ahmad and Pac O’Shea, Round Treasury has successfully raised $2.1 million in Pre-Seed funding to enhance its banking and treasury platform. This platform is specifically tailored to simplify the financial lives of founders and CFOs, making it easier for them to manage their organizations’ finances effectively. The funding round was spearheaded by Passion Capital, with participation from notable investors and venture funds such as Tiny VC, Ascension, Samos Investments, and Entrepreneur First, among others. In addition, individual investors like Darren Westlake (founder of Crowdcube) and Simon Taylor (11FS) contributed their expertise and resources to support the fledgling company.

At the helm of Round Treasury, CEO Pac O’Shea and co-founder Hayyaan Ahmad are on a mission to reshape how startups interact with their financial needs.

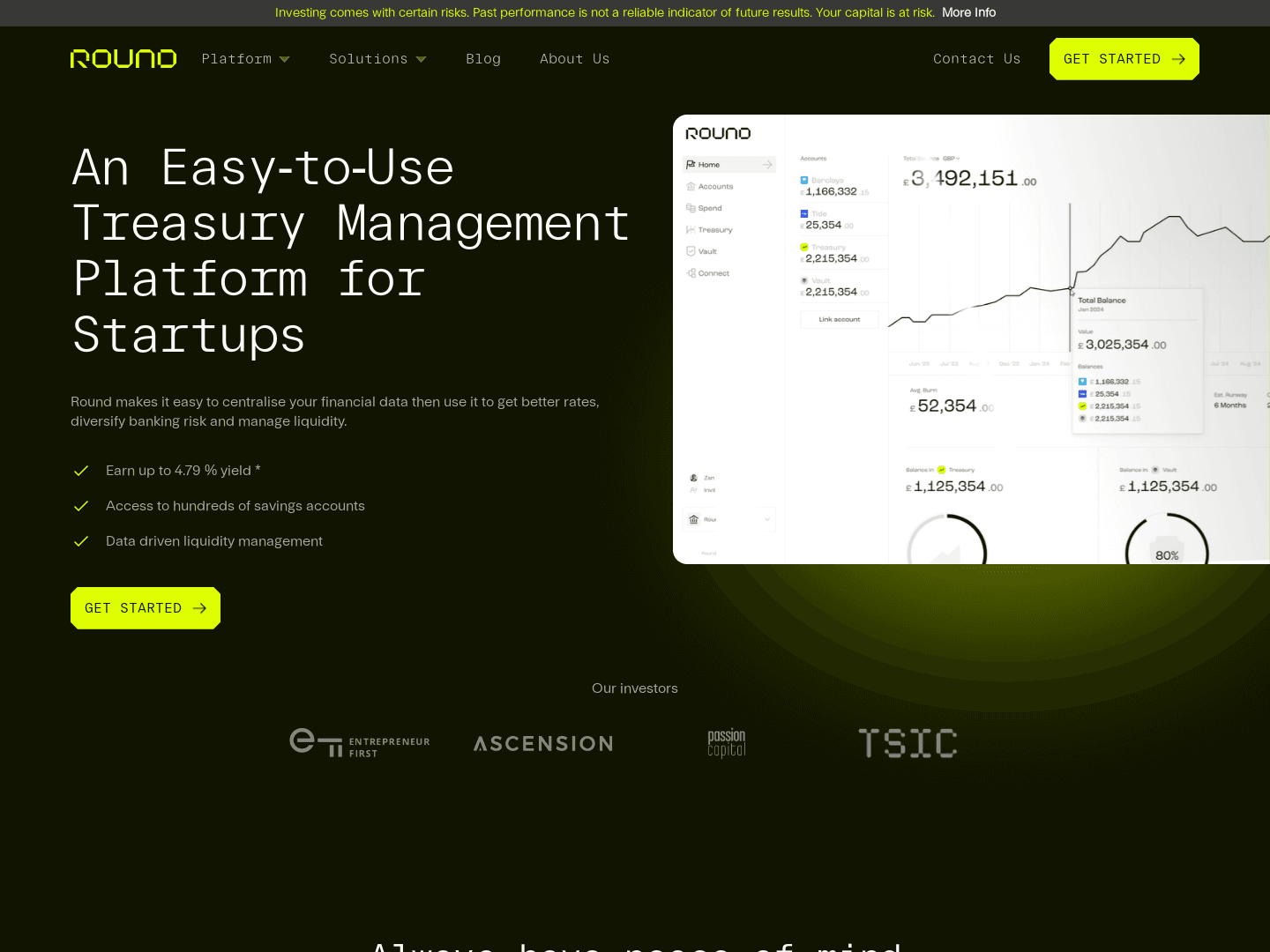

Utilizing the newly acquired funds, the company plans to expand its team, fine-tune its product offerings, and broaden its services throughout Europe. The startup’s unique selling proposition lies in its comprehensive suite of banking and treasury services designed specifically for startups. This includes vital features such as multibanking capabilities, treasury solutions, and diversified savings accounts, all consolidated into a single platform that allows users to manage their financial tools efficiently. This not only streamlines operations for busy founders and CFOs but also maximizes their financial control with minimal hassle.

One of the standout features of Round Treasury’s offering is its treasury solution, which empowers startups to extend their financial runway while simultaneously facilitating team growth. By leveraging government security-backed Blackrock money market funds, the platform enables businesses to earn as much as 5% yield, all with next-day liquidity. Furthermore, the multibanking functionality provides clients with the convenience of managing all their existing bank accounts from one interface, eliminating the administrative burdens typically associated with multiple accounts. Another valuable feature is the Vault Savings Accounts, which give businesses access to numerous savings accounts across UK banks without the need to establish individual accounts. This arrangement not only amplifies financial security by enhancing FSCS protection but also ensures that deposits are distributed among several banks, thereby mitigating risks for the businesses involved.

They've invested in Round Treasury

Get to know these Fintech investors

Click here for a full list of 6,908+ startup investors in the UK