TransFICC Secures $25 Million to Enhance Trading Solutions

Revolutionizing the Trading Landscape: TransFICC's Impressive $25 Million Funding Round

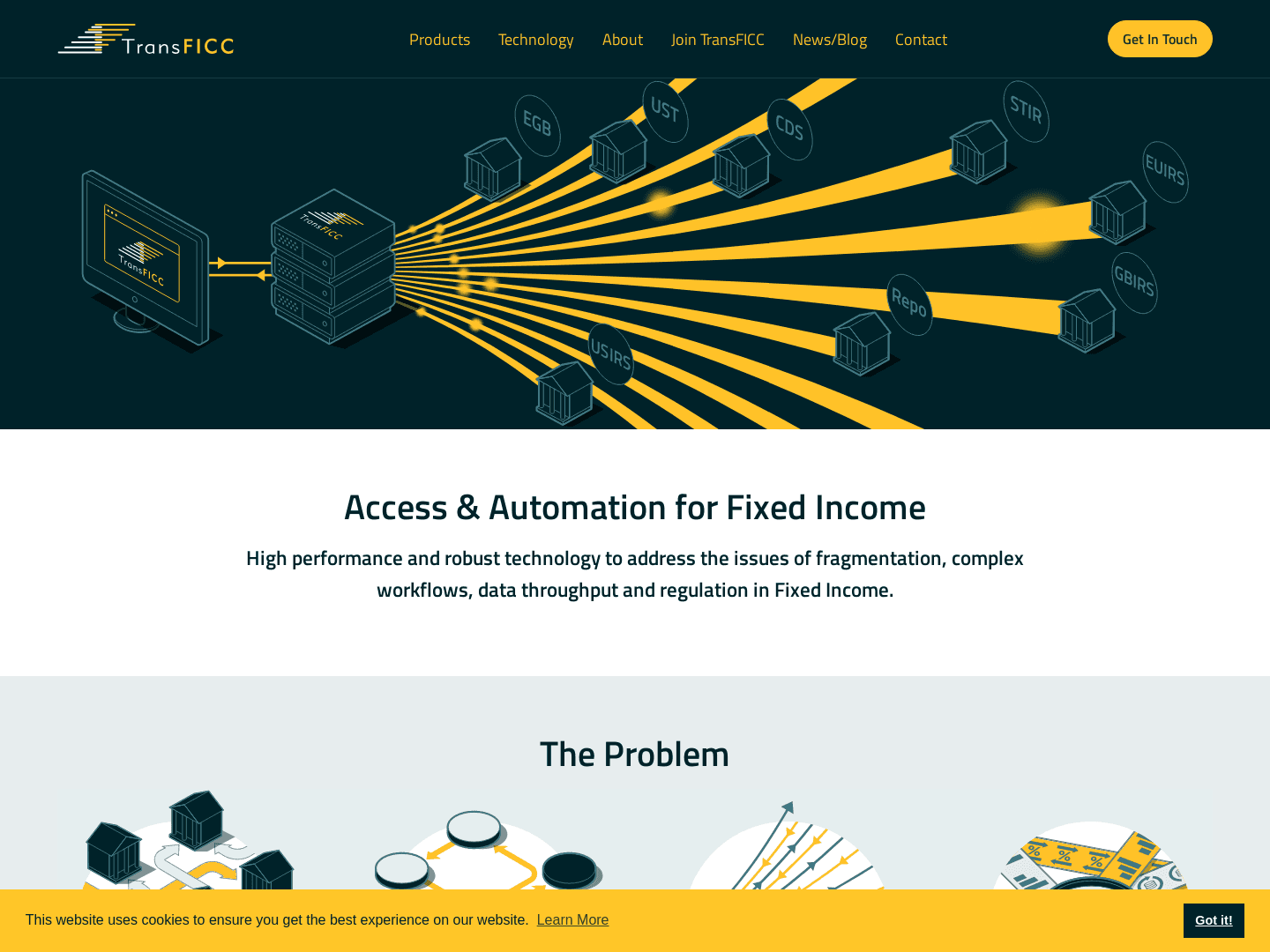

In a bold move that underscores the accelerating pace of innovation in the financial sector, TransFICC, a specialist provider of low-latency connectivity and workflow services for Fixed Income and Derivatives markets, has announced a significant $25 million funding injection. This Series B investment, led by the esteemed Citadel Securities, alongside contributions from BlackFin Tech and existing investors, brings TransFICC's total funding to $50 million. Such financing demonstrates a robust commitment from prominent players, including AlbionVC, Citi, HSBC, Illuminate Financial, ING, and Neosfer, emphasizing the company’s pivotal role in the evolution of electronic trading.

According to Amit Bhuchar from Citadel Securities, their partnership with TransFICC is a forward-thinking approach to tackling complex liquidity and execution challenges in the Fixed Income market.

With structural shifts—ranging from the rise of algo tools, the growth of all-to-all markets, to the burgeoning popularity of Fixed Income ETFs—there's an undeniable increase in demand for automated trading solutions. TransFICC's recent launch of TransACT (Automated Customer Trading) exemplifies its innovative spirit as it expands beyond Credit to include Government Bonds, IRS, and Repo transactions. This is not just a funding story; it’s about backing a vision for the future of trading.

As Steve Toland, Co-Founder of TransFICC, remarks, “Wide-ranging structural changes are driving volumes up, creating demand for automated solutions.” The urgency for market makers to respond quickly to win business has never been greater, and TransFICC is poised to meet that challenge head-on. With data centre hosting established in strategic locations across North America, Europe, and Asia, as well as enhanced support for client applications, TransFICC is redefining industry standards for connectivity and efficiency. In a market increasingly characterized by complexity, the startup is committed to providing streamlined, cost-effective solutions to support 20 market participants and three exchange groups, ensuring that Fixed Income trading is not just efficient but also future-ready.

Key Terms Explained

- TransFICC

- A specialist provider of low-latency connectivity and workflow services for fixed income and derivatives markets.

- $25 million funding round

- A significant capital infusion into TransFICC from a pool of investors, which totaled $25 million in this round.

- Citadel Securities

- A prominent global market maker and key investor in TransFICC in this particular funding round.

Frequently Asked Questions

- Who led the Series B investment in TransFICC?-The Series B investment in TransFICC was led by Citadel Securities.

- What was the total amount raised by TransFICC in the latest funding round?+

- What is the total funding amount raised by TransFICC to date?+

- What is TransFICC's new product and what markets does it cover?+

- Who are some of the prominent investors in TransFICC?+

They've invested in TransFICC

Get to know these Fintech investors

Click here for a full list of 6,908+ startup investors in the UK