Zopa Secures £75 Million to Fuel Digital Banking Growth

In the hyper-competitive landscape of digital banking, Zopa is making waves with its recent achievement of raising £75 million in Tier 2 Capital. This significant funding milestone not only underscores the growing investor confidence in Zopa but also strengthens its position as a standout player among UK digital banks. With a total capital raised of £530 million to date, including an impressive £150 million in 2023 alone, Zopa is poised for an accelerated growth trajectory that startup founders and savvy investors should keep a close eye on.

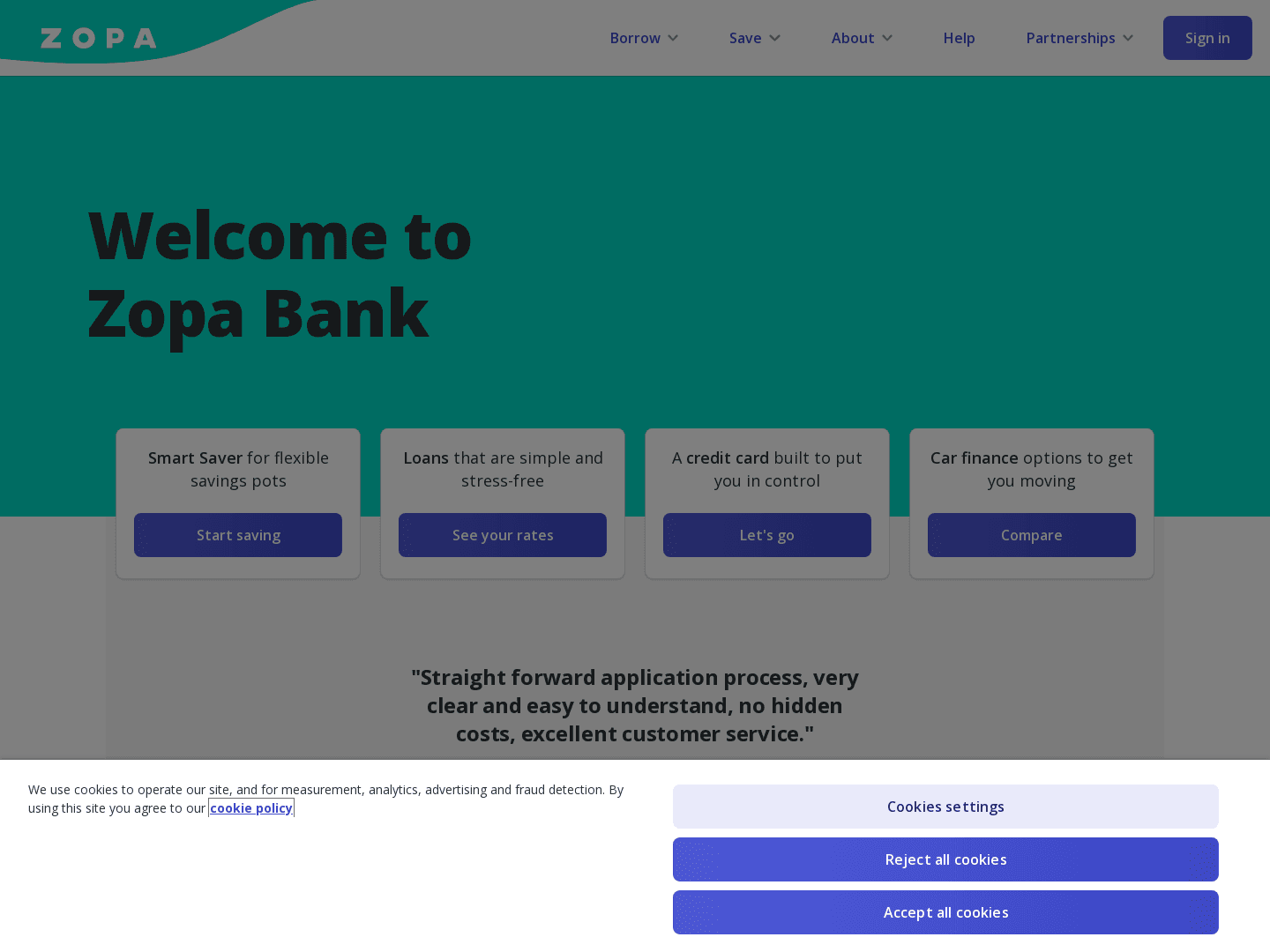

Under the leadership of CEO Jaidev Janardana, Zopa operates as a real bank, boasting an 18-year heritage in peer-to-peer (P2P) lending and an impressive £8 billion in approved personal loans.

What sets Zopa apart from traditional fintechs is its robust portfolio, including the recent launch of regulated Buy Now, Pay Later (BNPL) products and an innovative smart ISA. These offerings reflect Zopa's commitment to meeting diverse customer needs and enhancing its market presence. Furthermore, with a current customer base of 1 million and an annualized run rate revenue of £250 million, Zopa is strategically positioning itself to reach 5 million customers by 2027.

As Zopa continues to attract funding and innovate within the banking sector, it presents a compelling opportunity for investors looking to make an impact in the digital finance space. With a remarkable track record and a clear growth strategy, Zopa demonstrates not only the potential for substantial financial returns but also the capacity to reshape how customers engage with banking services. This is a case study for startup founders seeking inspiration and investors contemplating where to allocate their capital for maximum growth. The future looks bright for Zopa and the evolving landscape of digital banking.

Key Terms Explained

- Tier 2 Capital

- Tier 2 capital is the secondary component of a bank's capital requirements, comprising of undisclosed reserves, revaluation reserves, general loan-loss reserves, and subordinated term debt.

- Buy Now, Pay Later (BNPL)

- BNPL is a type of financing that allows customers to purchase items immediately but pay for them over time, usually via installment payments. It is a prevalent service offered by fintech and e-commerce companies.

- Annualized run rate revenue

- Annual run rate is a method of forecasting annual earnings based on revenue from a specific period (like a quarter or month). The figure helps to extrapolate expected financial performance over the entire year.

Frequently Asked Questions

- How much funding has Zopa raised to date?-Zopa has raised a total capital of £530 million to date.

- What distinguishes Zopa in the digital banking sector?+

- What are Zopa's growth targets in terms of customers?+

- Which new financial products did Zopa recently launch?+

- How much did Zopa raise in 2023?+

Click here for a full list of 7,526+ startup investors in the UK