Zopa Secures €80 Million to Propel Fintech Growth

In the competitive landscape of fintech, Zopa is making waves with a fresh infusion of cash, demonstrating the confidence of investors in its vision. The London-based digital bank has successfully secured €80 million in equity funding, with industry heavyweight A.P. Moller Holding at the helm of this latest investment round. As startups continuously strive for innovation, Zopa’s goal is crystal clear: to launch its flagship current account and introduce its groundbreaking GenAI proposition by 2025.

Under the leadership of CEO Jaidev Janardana, Zopa has cultivated an impressive track record over the past two decades, lending over £13 billion to UK consumers.

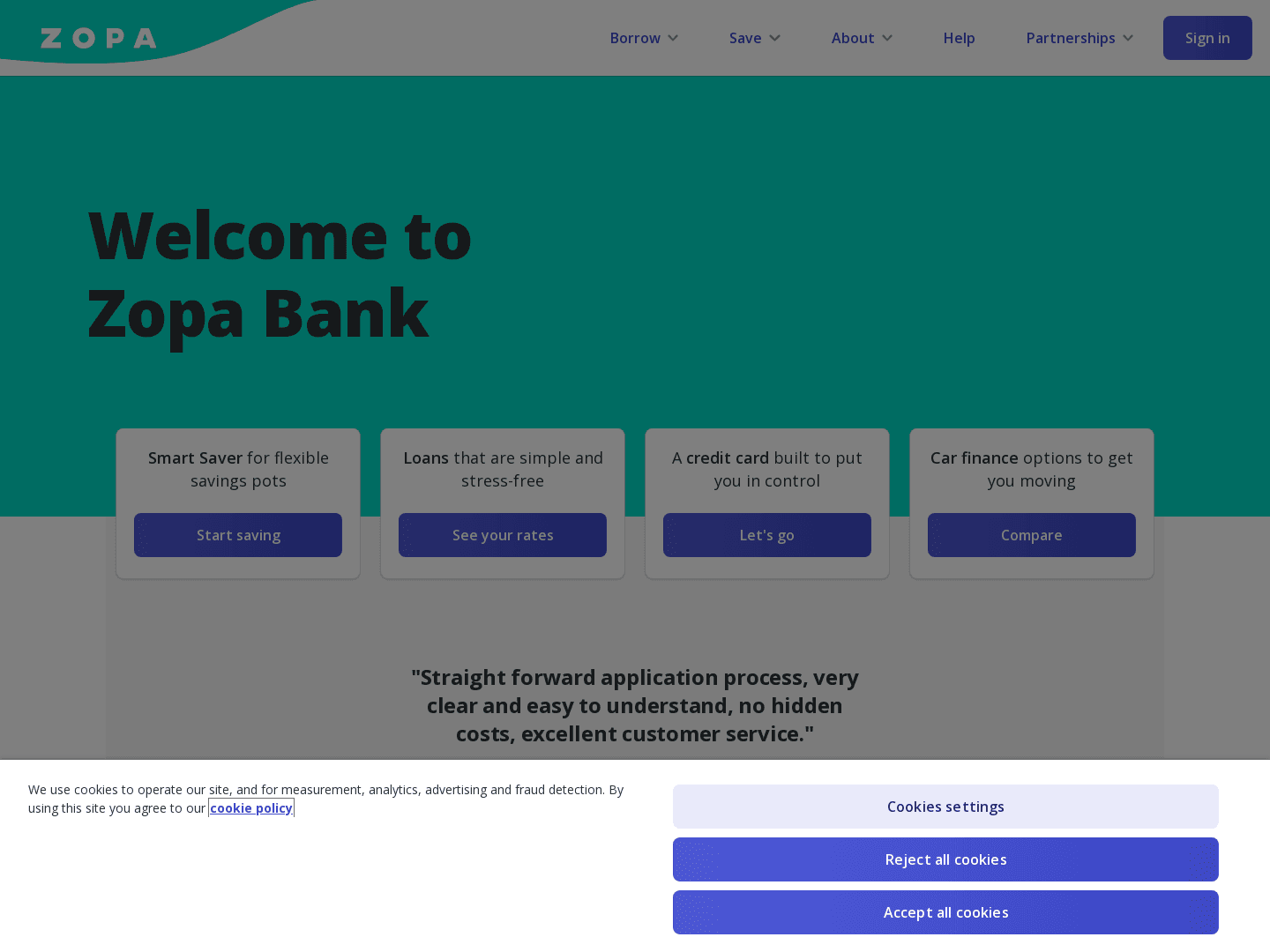

Since obtaining its banking license in 2020, Zopa has rapidly expanded its offerings to encompass current accounts, unsecured personal loans, point-of-sale financing, car loans, credit cards, and savings accounts. This diverse portfolio has attracted upwards of £5 billion in deposits, as Zopa now holds £3 billion in loans on its balance sheet.

What sets Zopa apart is not only its robust financial performance but also its commitment to employee satisfaction. With a growing team of nearly 850 individuals, Zopa boasts one of the highest employee satisfaction scores in the UK fintech sector, underscoring its dedication to fostering a positive work culture. As Zopa embarks on its next phase of expansion, this latest funding round positions the company as a formidable contender in the fintech arena, poised to capture the attention of both customers and investors alike.

Key Terms Explained

- Equity Funding

- A method of raising capital by selling company shares to investors. In return for the investment, the shareholders receive a portion of the company's equity.

- Banking License

- A legal permission granted by a regulator allowing a company to conduct banking business, including services like loans, deposits, and offering credit cards.

- Investment Round

- A type of financing stage where a business raises capital from investors or venture capitalists to fund the company's operations and growth.

Frequently Asked Questions

- Who led the latest investment round for Zopa?-The latest investment round for Zopa was led by industry heavyweight A.P. Moller Holding.

- How much funding did Zopa secure in its latest equity funding round?+

- What services does Zopa offer?+

- What is Zopa's goal by 2025?+

- What makes Zopa stand out in the fintech sector?+

They've invested in Zopa

Get to know these Fintech investors

Click here for a full list of 7,526+ startup investors in the UK