Loans for UK startups

Need funding but don’t want dilution? Use this page to find the safest type of startup loan or facility for your situation.

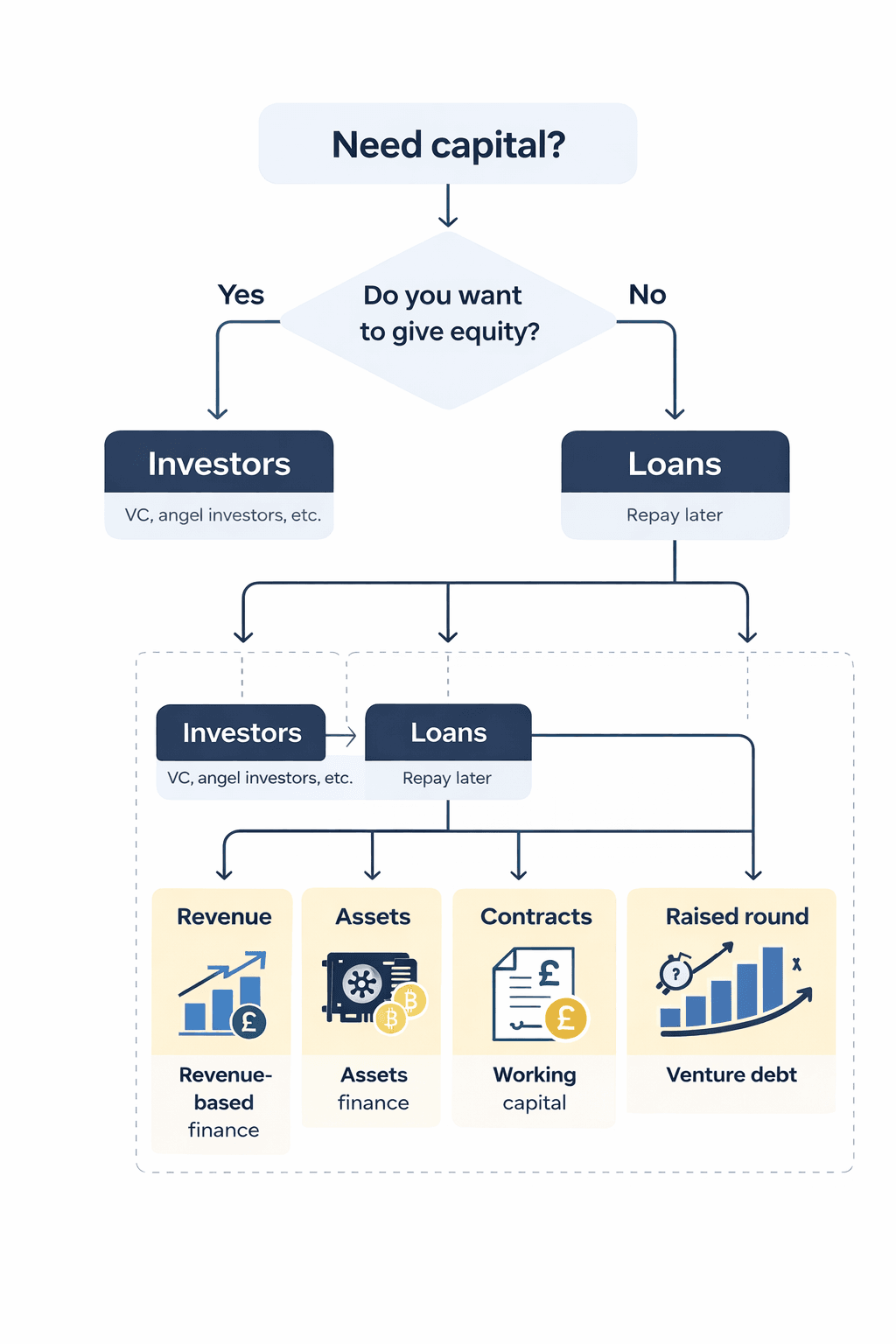

UK startups use loans and facilities for three common reasons: to extend runway between rounds, to fund growth once revenue is predictable, or to finance assets and cashflow without giving away shares. “Loans” covers several products, from public startup loans and regional programmes to venture debt, revenue-based finance, working capital solutions, asset finance, and revolving credit facilities. Use the decision table below to jump straight to the right category.

Most founders land here when they want runway without raising again.

Simple trade-off: investors buy upside, lenders expect repayment. If repayments would be stressful or uncertain, equity may be safer.

Which loan type fits your situation?

Use this table to jump straight to the right category.

Loan categories

Each category page explains eligibility, common terms, and typical UK providers.

Startup loans

Venture debt

Revenue-based financing

Working capital

Asset finance

Credit facilities

Real examples from Startupmag

These are real funding stories showing how founders use loans and facilities in practice.

When loans are a bad idea

- You cannot predict repayments. If your next 6 to 12 months are uncertain, debt can amplify stress.

- Your revenue is not reliable. Many products here assume predictable cashflow, contracts, or assets.

- You are raising your first capital. Equity is often safer early on unless you qualify for a public programme.

FAQs

Is a loan the same thing as venture debt?

Venture debt is a type of loan designed for venture-backed companies, typically raised alongside or after an equity round. It often has different terms and expectations than a standard business loan.

Can pre-revenue startups get loans in the UK?

Sometimes. Pre-revenue startups are more likely to qualify through public or regional programmes rather than commercial lenders. Eligibility depends on the programme, the region, and the business profile.

When should a startup avoid loans?

Avoid loans if you cannot predict repayments, your runway is highly uncertain, or your revenue is not reliable. Debt can be useful, but only when repayment risk is genuinely manageable.

Do loans always require personal guarantees?

Not always. Some startup-focused facilities are secured against revenue, assets, or contracts, while others may require guarantees. It varies by provider and product type.